Explore the key trends reshaping skilled nursing in 2026: AI innovation, Medicare Advantage challenges, workforce solutions, and the essential shift toward collaborative care.

The skilled nursing sector enters 2026 with renewed momentum, having weathered significant regulatory uncertainty throughout 2025. With the federal staffing mandate now rolled back, providers can redirect their focus toward stability and strategic expansion. However, this shift comes alongside a complex landscape of policy changes, payment reforms, and evolving consumer expectations that will define the industry's trajectory this year.

Regulatory Evolution: Less Oversight, More Opacity

The Trump administration's lighter regulatory touch has brought both relief and new challenges. While initiatives like the indefinite suspension of mandatory off-cycle provider enrollment validation signal reduced compliance burdens, operators now face communication bottlenecks and last-minute updates from the Centers for Medicare and Medicaid Services (CMS).

Infection prevention remains a critical concern, particularly as pandemic-era protocols like masking mandates have been disabled. This comes at a time when flu-like symptoms have reached their highest levels in 25 years, creating heightened vulnerability for nursing populations. Facilities must remain vigilant about emerging superbugs and new virus strains while navigating constantly evolving infection control guidelines and reporting processes.

Documentation accuracy has become increasingly critical under updated skilled nursing facility payment rules, coding standards, and PDPM/ICD-10 mapping requirements. Organizations are strengthening their quality assurance and performance improvement programmes beyond basic regulatory compliance, focusing on trend identification and frontline staff engagement. Notably, facility assessments, a Biden-era provision, will continue as more than just a checkbox exercise, providing valuable insights into staffing levels and operational readiness.

Investment Surge Signals Sector Confidence

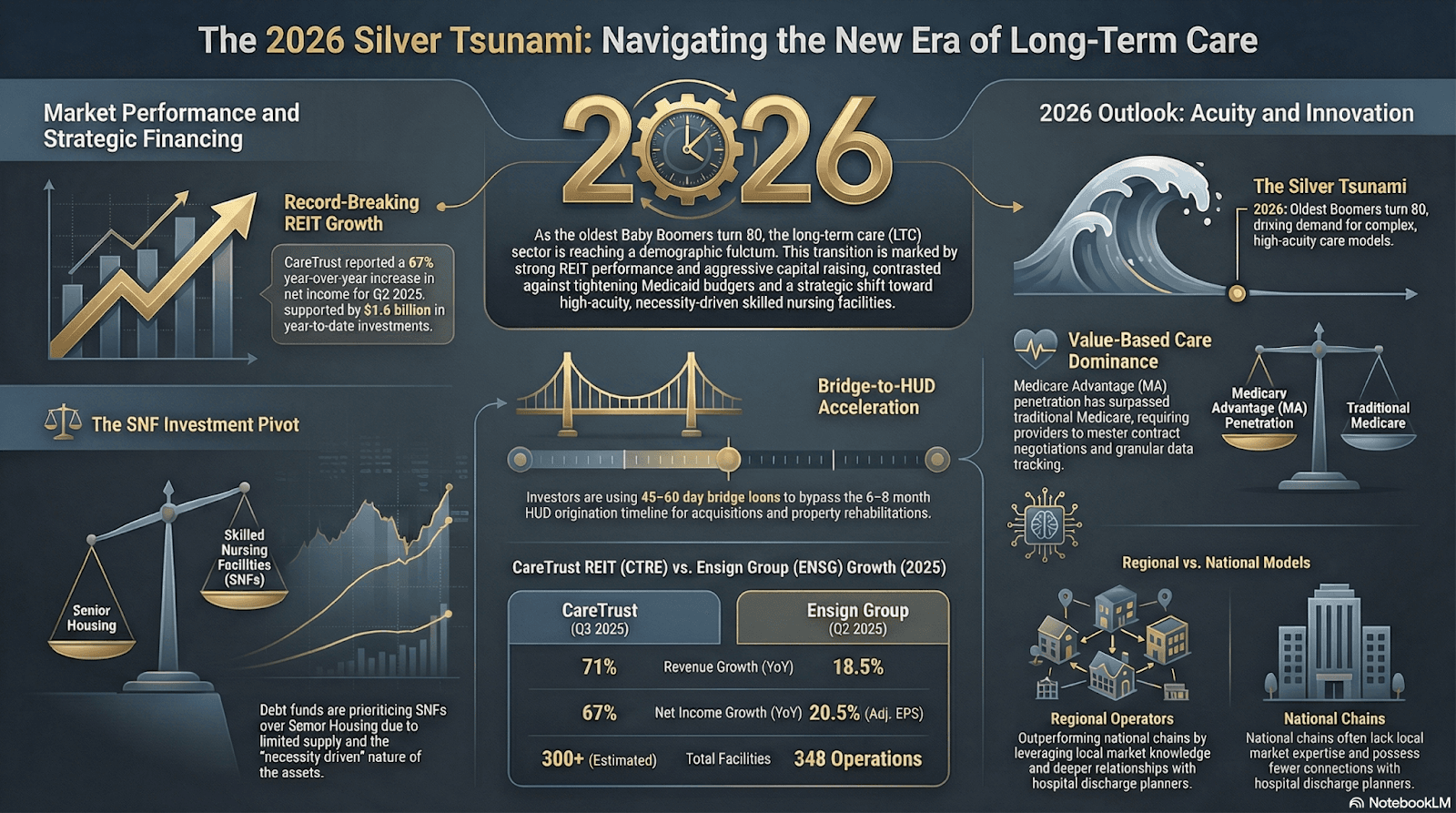

The skilled nursing sector is showing renewed strength, with major investment activity pointing to growing trust in its long-term fundamentals despite broader economic uncertainty.

Why Investors Are Bullish

Multiple structural and policy-driven factors are improving the sector’s risk–reward profile, making skilled nursing more attractive to institutional and private investors.

- Strong deal flow despite macro uncertainty

- Improved Medicaid reimbursement rates

- Healthier state budgets supporting transactions

- More portfolios qualify for HUD loans.

Notable Recent Activity

Recent large-ticket deals highlight how capital is being deployed and which players are driving momentum in the market.

- CareTrust:

- $1.8B+ in investments closed in 2025

- $142M Mid-Atlantic portfolio acquisition to start 2026.

- Northwind Group:

- $342.5M healthcare debt fund closed

- ~70% allocated to skilled nursing assets.

Capital Sources Powering Growth

Funding is coming from a wide mix of traditional and alternative channels, giving operators more flexibility in how they finance expansion and acquisitions.

- Traditional lenders and banks

- Bridge financing arrangements

- HUD-insured financing for scalable, lower-risk growth.

Market Dynamics

Shifting ownership patterns are reshaping the competitive market, with consolidation accelerating across the sector.

- Increased consolidation among large private operators

- Smaller, family-owned facilities exiting the market

- Active acquirers: Omega, Welltower, Ensign.

What This Signals

Together, these trends point to a sector entering a more stable and investable phase, with improving fundamentals supporting long-term growth.

- Sustained investor confidence

- Expectations of sector stability

- Limited new supply supporting fundamentals

- Operators can scale without heavy strain on operating cash flows

Medicare Advantage: A Double-Edged Sword

Medicare Advantage is rapidly reshaping post-acute care, creating both financial pressures and strategic opportunities for skilled nursing providers. As enrollment grows, ongoing reimbursement challenges, administrative hurdles, and policy shifts continue to redefine care delivery and sustainability.

- Medicare Advantage (MA) enrollment is projected to reach nearly 60% of Medicare beneficiaries within two years, significantly shaping skilled nursing operations.

- Despite higher-than-expected 2026 MA payment rates approved under the Trump administration, tensions persist between MA plans and skilled nursing providers.

- MA plans typically reimburse 10%–20% less than traditional Medicare and impose heavy administrative requirements.

- Providers face frequent admission denials or delays, with MA plans often steering patients to lower-cost care settings.

- Hospitals increasingly retain patients longer while awaiting MA authorizations or in-network placements, especially for high-acuity cases (e.g., wound care, IV antibiotics, respiratory support).

- Delayed transfers result in patients arriving at skilled nursing facilities weaker, reducing their recovery potential.

- Some insurers are scaling back MA plan offerings, adding uncertainty for both seniors and providers.

- The MA payment increase could strengthen skilled nursing facilities’ negotiating leverage and support value-based care participation.

- Ongoing concerns remain about MA payment models underfunding high-acuity care.

- Recent lawsuits underscore continuing disputes over MA practices and reimbursement fairness.

Artificial Intelligence: From Optional to Essential

Artificial intelligence is becoming essential in healthcare. In 2026, AI integration is reshaping care delivery, operations, and patient expectations.

AI Becomes a Healthcare Necessity

The adoption of artificial intelligence has shifted from optional to essential in 2026. The launch of ChatGPT Health, which connects medical records and wellness apps, highlights how deeply AI is reshaping healthcare delivery. Patients and families now arrive at facilities with AI-generated insights and questions, changing how care conversations unfold.

AI-Driven Operational Efficiencies

Providers are using AI to improve operations through advanced electronic medical records, AI-supported monitoring, and predictive analytics. These tools enable earlier intervention for pressure ulcers, infections, and falls by tracking real-time data such as vitals, temperature trends, hydration, gait changes, and wound progression, helping clinicians treat residents in place and reduce hospitalizations.

Slow Adoption in Nursing Homes

Despite its promise, AI adoption in nursing homes lags behind other healthcare settings. Usage rose from 3.1% in 2023 to 4.5% in 2025, compared to the broader healthcare average of 8.3%. Limited IT funding and the lack of federal incentives remain key barriers, with most current use centered on embedded platforms for fall detection, clinical decision support, and revenue cycle management.

Workforce Pressures and Technology Expansion

As staffing challenges grow and documentation requirements become more complex, broader technology adoption is increasingly inevitable. Providers are seeing success managing state-specific payer models and PDPM variations using real-time reimbursement alerts, predictive tools, and unified dashboards.

Innovation and Investment Momentum

AI startups focused on nursing home solutions are attracting significant funding, accelerating innovation across the sector. This influx of capital is helping drive new tools that support clinical care, compliance, and financial performance for long-term care providers.

Value-Based Care Models Reshape Payment Landscape

The Transforming Episode Accountability Model launches in January 2026, tracking patients through 30-day episodes for five surgical procedures. Readiness among skilled nursing facilities varies widely, with some proactively educating hospital partners while others are just beginning data analysis. With conveners eliminated from TEAM, nursing homes have greater opportunity to capture value, but must put forward concrete partnership structures to forge meaningful hospital collaborations.

The Guiding an Improved Dementia Experience model, launched in July 2024 and running through 2032, aims to provide wraparound services for dementia patients. While implementation has proven challenging due to staffing shortages and nationwide flat payments, some providers report success when leveraging existing care coordination infrastructure. CMS plans to refine GUIDE based on early feedback.

Looking ahead, the Long-term Enhanced ACO Design model will launch on January 1, 2027, replacing ACO Reach. LEAD addresses historical obstacles to skilled nursing participation by offering flexible payments, resources, and greater freedom to support patient care, particularly for specialized populations.

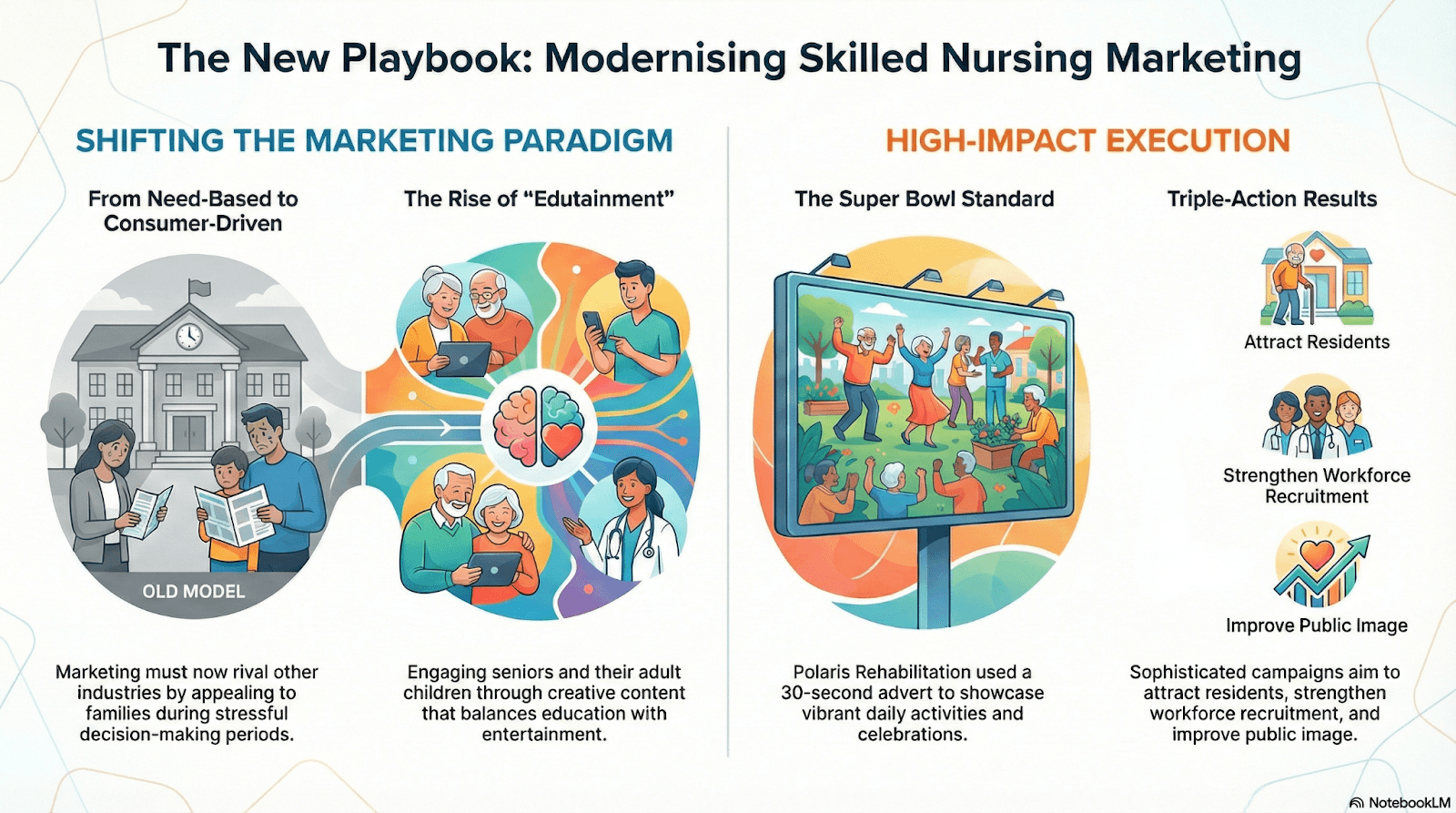

Consumer-Driven Marketing Evolution

Changing consumer expectations are prompting sophisticated marketing approaches that rival other industries. Marketing skilled nursing presents unique challenges, as it involves promoting services people need rather than want, typically during stressful times. However, as the consumer base evolves, successful campaigns increasingly employ creative, multi-generational strategies.

Some facilities are embracing "edutainment" approaches that engage not only seniors but their adult children and grandchildren. The trend reached new heights with a 30-second Super Bowl commercial showcasing Wyoming's Polaris Rehabilitation and Care Center, complete with rehab equipment, daily activities, Miss Wyoming, and bingo celebrations with confetti cannons.

While Super Bowl advertising remains out of reach for most providers, expect more facilities to adopt sophisticated marketing strategies to attract residents, strengthen workforce recruitment, and shift public perception. These NFL-style tactics aim to build strong teams and draw attention during critical moments.

Preparing for the Road Ahead

As 2026 unfolds, skilled nursing providers face a complex interplay of opportunities and challenges. The rollback of federal staffing mandates provides operational flexibility, but ongoing Medicaid cut proposals under the One Big Beautiful Bill Act and Medicare Advantage expansion create financial uncertainty. Reduced federal agency capacity introduces communication challenges even as oversight intensity varies.

Success in this environment requires providers to strengthen documentation practices, embrace technology strategically, forge proactive partnerships for value-based care models, navigate Medicare Advantage complexities with clear-eyed realism, and invest in marketing that resonates with evolving consumer expectations. The facilities that thrive will be those that view 2026's challenges not merely as obstacles to overcome, but as catalysts for transformation that ultimately strengthen the sector's foundation for years to come.